While the economy of many countries remains unstable during the current pandemic, thousands of people struggle to make ends meet and finance their urgent expenses. This is a challenging time for many of us.

Those who have moved and lost their regular jobs face many financial obstacles such as rent payment. There are various solutions that are meant to help renters make on-time payments and avoid eviction. Keep on reading to compare your options.

Current Moving Statistics

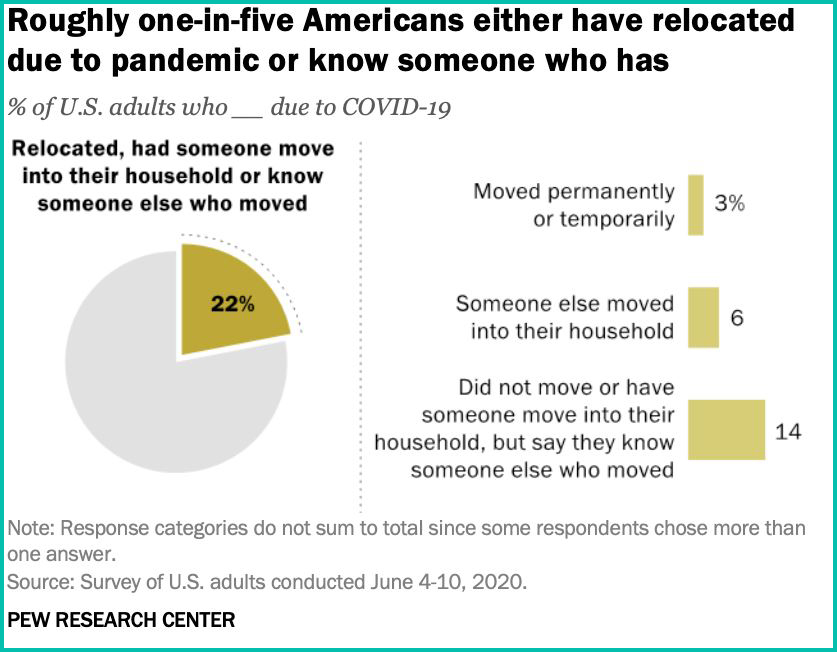

According to the Census Bureau 2020 CPS ASEC Geographic Mobility Data, about 29.8 million people reported moving from one place to another within this year. The coronavirus pandemic is responsible for a significant change in the way people work and live. Many families were forced to leave cities and move to rural areas due to unemployment and job losses.

Those who keep on working from home also wanted to move to a safer and quieter place outside the city center and pay less for rent. Utility and rent payments have increased so that it has become even more challenging to make ends meet and pay the landlord regularly.

Lots of low-income households and those who were fired had to seek other ways of supporting their families. There are several ways you can use if you also feel pressed for funds and need financial assistance to cover rent and bills.

Assistance From the Government

While many consumers need help paying rent, they may search for the most suitable solution. There are government programs that help pay rent such as the Emergency Rental Assistance program.

It offers funding to low-income families and people with disabilities who can’t afford to make on-time payments. This program is divided into two sections: ERA1 and ERA2. ERA1 program offers up to $25 billion under the Consolidated Appropriations Act, 2021.

ERA2 program offers $21.55 billion under the American Rescue Plan Act of 2021. The funding is distributed among various places that help pay rent so you should contact your local authorities in order to apply.

There are two ways of applying for this program. You may either submit an application at the local community yourself, or the landlord may need to submit their application in advance.

Pros:

- cover rent payments

- pay home energy and utility costs

- cover Internet fees

- fund moving expenses

Cons:

- you need to tell your landlord about it

- at least one member of the family has to be unemployed

- you need to have large overdue bills

Assistance as a Rent Loan

Another suitable solution is to obtain a small loan to pay utility bills or use if you can’t pay rent, need help. Taking out a small personal loan is a quick lending option tailored to the needs of consumers who face financial obstacles and can’t make the ends meet. When the rent payment is too high for your family, getting monetary aid from a crediting institution may seem a reasonable option.

You may be offered a loan from the local bank, credit union, or from alternative lenders. The local banks deal only with good credit holders so if your rating is less-than-stellar you may have issues with the application.

Credit unions also approve requests only from their members so it may take some time to join the membership and apply for financial assistance. Alternative lenders offer the quickest solution in the form of small loans online. If your bills are overdue, I need help paying my rent asap, or the landlord tells you about possible eviction, it is important to act quickly.

Pros:

- quick financial assistance

- soft credit inquiry

- online application

Cons:

- a smaller amount of cash

- you need to have a steady source of income

- be employed

Assistance From Your Family

What if you don’t meet the eligibility criteria to apply for a loan or government program? Can I still get fast help pay my rent? You may tap your friends or family members and ask them to give you the desired amount. They may also pay for your rent or cover the overdue bills for you until your financial situation becomes stable again.

This option is suitable for people who can’t qualify for lending services or for assistance from the government. This is your chance to avoid fees and interest rates as your relatives and friends will most likely provide you with the desired cash with a flexible repayment term.

Pros:

- you don’t need to take out a loan

- no credit check or any requirements

Cons:

- risk of losing relationships

- you may get rejected

Alternative Solution

If you don’t want to risk losing your close relationships with friends or family members you may seek alternative solutions. One of them is to find a roommate or rent out a room in your house.

If you live in an apartment you may also rent out a spare room. This decision will give you extra money each month that will help you cover the rent and utility payments.

Some families or young students choose this solution if their credit history doesn’t allow them to qualify for the loan. Also, it’s a useful decision for low-income households when you want to lower your monthly rent payment. It may not be convenient in the long run but this option can definitely save you a few hundred dollars each month.

Pros:

- no credit obligations

- ability to lower your rent cost

Cons:

- inconvenient situation

- you have to share a house with a stranger

Summing Up

Don’t give up having short-term troubles with paying rent. Follow at least one piece of advice above and difficulties will disappear. You will significantly simplify your monetary situation. Just keep calm and try to pay rent in time!